The newly released Zillow homeownership costs report shows that Americans are now facing record‑high expenses when purchasing and owning a home, with rising interest rates and property taxes contributing to an increasingly heavy financial burden. As the housing market adjusts to post‑pandemic conditions and economic uncertainty, the report’s findings underscore how housing affordability is becoming a central concern for buyers and policy‑makers alike.

Key Findings from the Zillow Homeownership Costs Report

Interest Rates Drive Cost Surge

One of the major drivers of elevated homeownership costs is the increase in mortgage interest rates. With average 30‑year fixed mortgage rates hovering in the 7%‑plus range, monthly payments have surged, even for modestly priced homes. The Zillow homeownership costs report quantifies how each 1‑percentage‑point rise in rate translates into a nearly 8‑10% jump in monthly home costs — exacerbating affordability challenges.

Property Taxes and Maintenance Also Rising

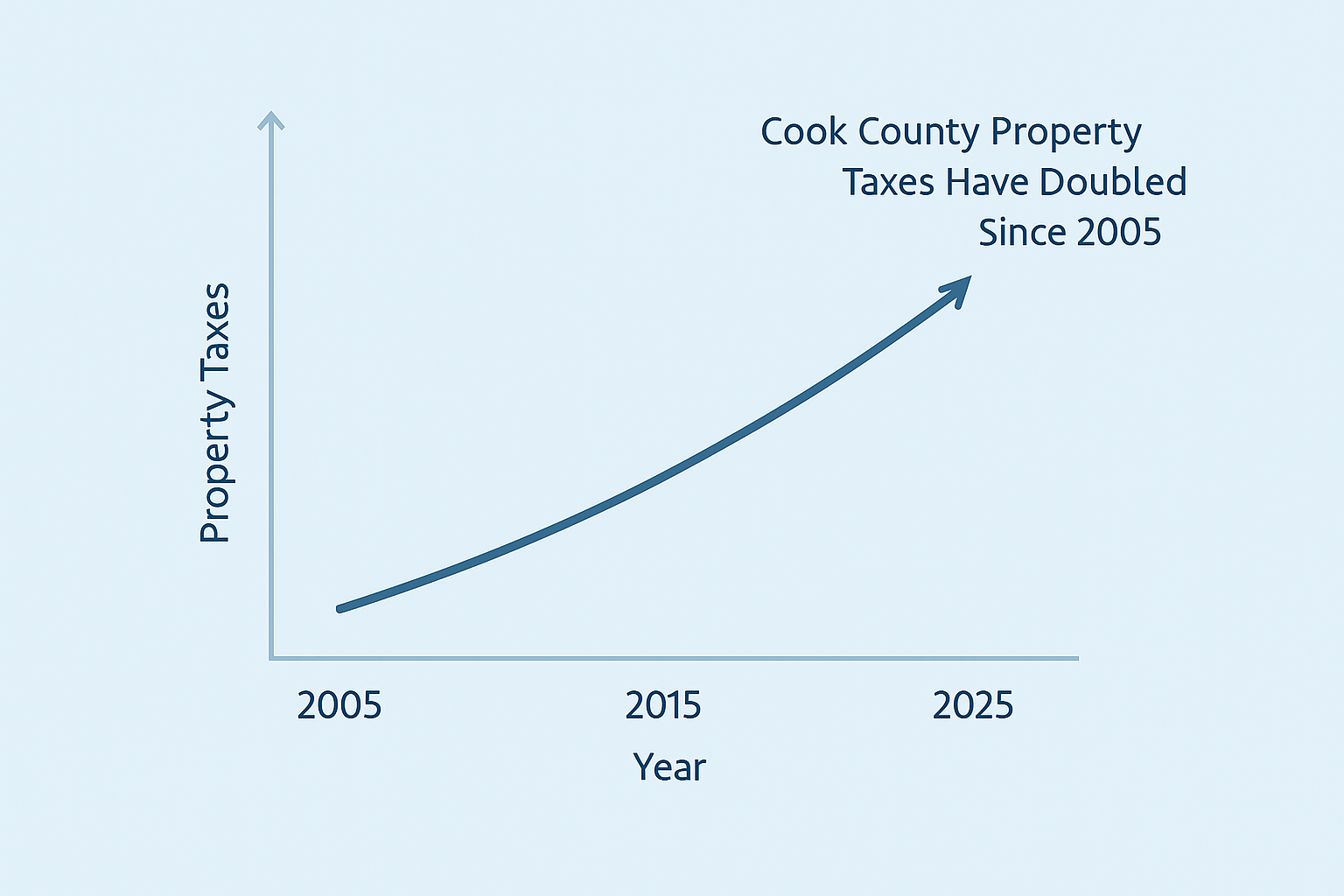

Beyond mortgage payments, the Zillow homeownership costs report highlights that state and local property taxes have increased at above‑average rates over the past year. Similarly, expenses for homeowners insurance, regular maintenance, and utilities have all ticked upward — narrowing the gap between owning and renting. These non‑interest cost components now represent a larger share of overall homeownership outlays than in previous years.

Geographic Disparities in Cost Burden

The report uncovers significant variation in homeownership cost burdens across markets. In high‑cost metro areas such as San Francisco and New York, monthly homeownership costs are now exceeding $6,000 for median‑priced homes. In contrast, more affordable markets like Cleveland and Pittsburgh show monthly costs of around $2,500. However, even in lower‑cost markets, the rate of cost growth is steep — meaning affordability is tightening nationwide.

Strategic Analysis: Implications for Buyers, Market, and Policy

Buyers Face Tough Calculations

For many would‑be homeowners, the Zillow homeownership costs report signals the need for careful financial planning. Rising costs mean down‑payment savings alone are no longer sufficient; buyers must factor ongoing monthly burdens, tax obligations, and long‑term maintenance. Some potential buyers may delay purchases or turn toward renting as a more affordable short‑term alternative.

Market Impact: Slowing but Not Stopping

Higher homeownership costs could dampen demand, especially among first‑time buyers and cost‑sensitive segments. Slowing buyer activity has the potential to moderate home‑price growth or even lead to regional corrections. On the other hand, limited housing supply and structural demand may prevent dramatic price drops — meaning cost burdens may increase further before any meaningful relief appears.

Policy and Affordability Pressure

Policy‑makers and housing‑advocacy groups are closely watching the Zillow homeownership costs report as evidence that affordability is eroding. States and local governments may face pressure to cap property tax growth, expand first‑time buyer incentives, or reform zoning to increase supply. The report could galvanize legislation aimed at reducing the supply‑side cost of housing and adjusting tax burdens for low‑ and moderate‑income homeowners.

Risks and Long‑Term Considerations

Interest‑Rate Uncertainty

With inflation still more persistent than forecast, there is a risk that interest rates remain elevated or even rise further. That would continue to escalate homeownership costs and may push more buyers to the sidelines. Long‑term, the housing market could see stagnation unless rates become more favorable or wages increase significantly.

Supply Constraints and Cost Pass‑Through

Even if demand softens, structural constraints such as limited housing inventory and tight construction labor markets may keep home‑prices elevated. Developers facing high input costs may pass on those costs to buyers, negating affordability improvements. As a result, the cost baseline for homeowners may continue its upward trend.

Regional Risk Divergence

Some markets may experience more acute affordability stress. Regions with high taxes, weak income growth, or oversupply could face sharper pull‑backs in home‑prices or slower recovery. Conversely, markets with strong job growth, lower tax burdens, and new housing supply may hold up better — producing a bifurcated housing market landscape.

What to Monitor in the Weeks Ahead

- Mortgage Rate Trends: Any shifts in central bank policy or bond yields will affect rates, and thus homeownership costs.

- Local Tax Policy: Property‑tax reform or caps could offer relief in certain states; monitoring state legislatures is key.

- Housing Supply Metrics: Home‑building permits, construction starts, and inventory levels will signal how supply pressures evolve.

- Household Income Growth: Real income growth is fundamental for affordability; if wages stagnate, home‑cost burdens will worsen.

- Geographic Support: Watch which metro markets diverge — which areas show cost relief, which tighten further, and how migration flows respond.

Final Thought

The Zillow homeownership costs report serves as a wake‑up call: owning a home in America is becoming significantly more expensive, and the burden is spreading beyond coastal hot spots into more affordable markets. Rising interest rates, property taxes, and maintenance costs are squeezing budgets. For buyers, this means recalibrating expectations and priorities. For policy‑makers, it underscores the urgency of addressing affordability. As the housing market navigates this pressure‑point moment, the consequences will ripple across consumers, communities, and the national economy.

Credit: bizbeatz.com

Date: November 17, 2025